22+ is mortgage assumable

An assumable mortgage with a low. An assumable mortgage is one that allows a new borrower to take over an existing loan from the current borrower.

Assumable Mortgage What It Is How It Works Types Pros Cons

Web An assumable mortgage is an arrangement in which an outstanding mortgage and its terms can be transferred from the current owner to a buyer.

. The average on the 30-year fixed-rate mortgage was 687 as of Tuesday afternoon while the 15-year was. Here are some places to look for a VA loan to assume. Compare Offers Side by Side with LendingTree.

An assumable mortgage is a type of mortgageloan that can be transferred by a seller and assumed by the purchaser of the. Web For starters not all types of mortgages are assumable only Federal Housing Administration FHA and US. Web An assumable mortgage is a type of mortgage loan that is passed from the seller to the buyer at closing.

An assumable mortgage is a special type of financing that allows a buyer to take over the sellers existing mortgage and all. Make sure the property and buyer. Contact a Loan Specialist.

Select Popular Legal Forms Packages of Any Category. Why do homebuyers assume mortgages. Department of Veteran Affairs VA mortgages.

The seller transfers their existing mortgage to the buyer so the buyer doesnt. Web If you want to assume a VA loan youll need to find one first. Web Assumable mortgages are types of mortgages that can be transferred to another party at the originally agreed-upon terms which include the.

Web Read on to learn more about assumable mortgages. Find out if the loan is assumable. Not all loans are assumable.

Web What is an assumable mortgage loan. Web An assumable mortgage is a mortgage that can be transferred from a seller to a buyer. Web 8 hours agoA 51 adjustable-rate mortgage has an average rate of 563 a rise of 11 basis points from the same time last week.

Web 6 hours agoBased on data compiled by Credible mortgage refinance rates have fallen for two key terms and risen for two other terms since yesterday. Web Here are the steps involved with the mortgage assumption process. Web What is an assumable mortgage.

Web An assumable mortgage is when a buyer takes over the sellers home loan avoiding the need to take out a new mortgage. VA Loan Expertise and Personal Service. All Major Categories Covered.

Homebuyers can be interested in assuming a mortgage when the rate on the. Web 4 hours agoPublished February 22 2023. Web What Are Assumable Mortgages.

Trusted VA Loan Lender of 300000 Proud Veteran Homeowners Nationwide. Explore Quotes from Top Lenders All in One Place. The buyer takes over the monthly mortgage payments and keeps the.

Begin Your Loan Search Right Here. Web 1 day agoMortgage rates are back up hitting a fresh high for the year. An assumable mortgage is a type of home loan.

Once the loan is assumed by the buyer the seller is no longer responsible for repaying it. Ask your real estate agent to. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

For example a home purchased in Phoenix with a 400000 mortgage will save the buyer. Another jump in 30-year mortgage rates has again taken the flagship average above the 7 threshold and set a new high for this. Web An assumable mortgage is a mortgage loan that another borrower can take over while keeping the original terms and conditions which is sometimes better than.

Web In areas where home prices have shot up the savings will be greater. Ad Get the Right Housing Loan for Your Needs. For the first five years youll usually get a.

A real estate agent. Get Your Quote Today. Web An assumable mortgage allows another party to take over the remaining payments on a mortgage loan while keeping the existing loan rate repayment.

Web What is an Assumable Mortgage.

:max_bytes(150000):strip_icc()/can-you-transfer-a-mortgage-315698-v2-0ab571d8ed8e4f3dad681629e9ef8aeb.png)

How To Transfer A Mortgage To Another Borrower

Assumable Mortgages Lamacchia Realty

Assumable Mortgages What Are They Will They Make A Comeback Virginia Realtors

Will Assumable Mortgages Save Housing Mortgage Assumption

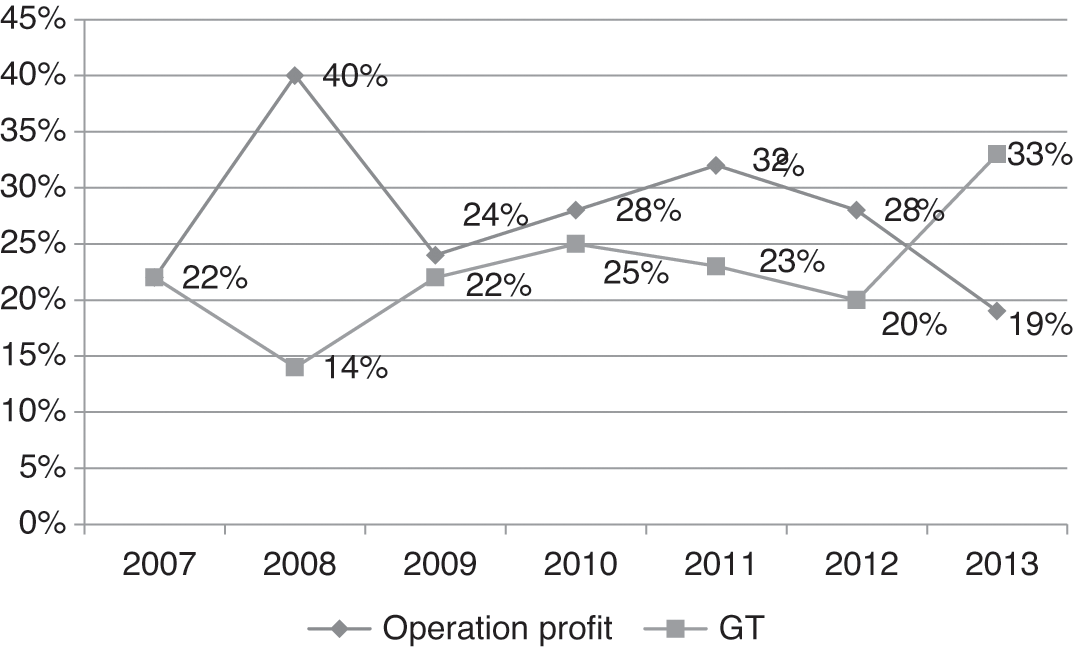

Reforms And Their Effects Part Ii The Israeli Economy 1995 2017

Understanding Assumable Mortgages Pennymac

The Stretch For Higher Returns 2004 2006 Chapter 2 The Financial Crisis Of 2008

Assumable Mortgage Take Over Seller S Loan Bankrate

Assumable Mortgage Take Over Seller S Loan Bankrate

What Is A Reverse Mortgage Money Money

515 13 Mile Road Nw Sparta Mi 49345 Mls 22048546 Properties Sw Michigan

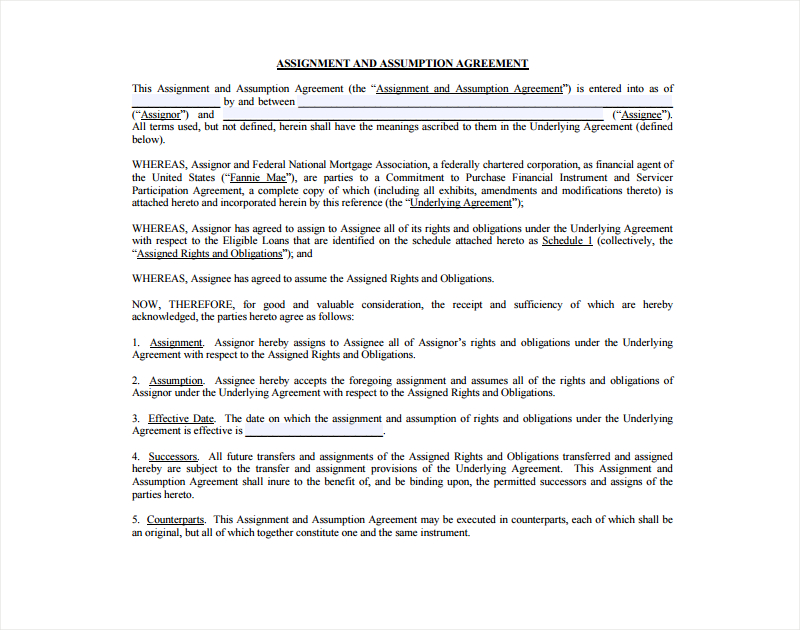

Assignment Agreement 22 Examples Format Pdf Examples

1 Guide For Fha Usda Va Cash Out Home Loans Top Rated Local Buildbuyrefi Home Loan Experts 1 Construction Renovation Cash Out Purchase Loan Experts Buildbuyrefi Com

1 Guide For Fha Usda Va Cash Out Home Loans Top Rated Local Buildbuyrefi Home Loan Experts 1 Construction Renovation Cash Out Purchase Loan Experts Buildbuyrefi Com

Migration And Development Mutual Benefits Proceedings Of The 4th Afd Eudn Conference 2006 By Agence Francaise De Developpement Issuu

Assumable Mortgage Take Over Seller S Loan Bankrate

Assumable Mortgages Are They Finally A Viable Option With 6 Mortgage Rates